Holiday Report Shows That Shoppers Expected to Choose Experiences Over Gifts

Amid a post-pandemic shift in spending from goods to services, shoppers are willing to shell out less on gifts this holiday season so they can put more toward fun and entertainment. According to a recently released report from global commercial real estate services firm JLL, U.S. consumers plan to allocate nearly a quarter of their holiday budget on “immersive” experiences in November and December, like visiting Santa Claus, attending a live performance or dining out.

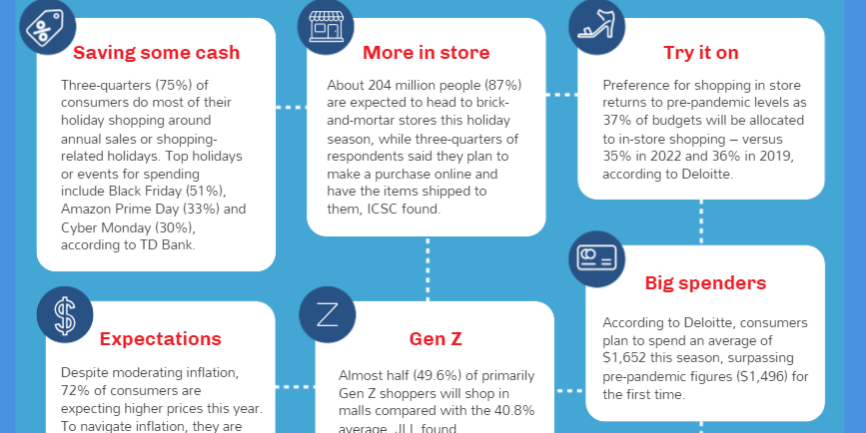

On average, holiday shoppers expect to spend $958 this season — 22.8% of which will be used on entertainment and services. When it comes to physical goods – gifts and other holiday merchandise like decorations – consumers will budget 13.8% less than last year, from an average of $868 per person in 2022 to $748 per person in 2023, JLL found.

The National Retail Federation also made note of service spending growth, saying it is “strong,” outpacing goods spending and back in line with pre-pandemic trends. In its forecast for the season, NRF said the desire for entertainment, restaurant dining and travel will likely define holiday sales trends as consumers may prioritize “their ability to spend during November and December celebrations.”

Though online sales continue to rise, brick-and-mortar remains a crucial part of the holiday landscape as a place for new product discovery and memorable excursions with family and friends, which is why retailers are making it a point to enhance the experience with immersive environments, exclusive promotions and special events.

Given the triumphant return of in-person shopping over the last two years, it is increasingly important for retailers to distinguish their brand amid growing competition, Levin Management Corp.’s chief executive officer Matthew Harding pointed out.

When it comes to physical retail’s advantages, the ability to offer in-person customer service and support were cited as the biggest by store managers who responded to a pre-holiday sentiment survey conducted across LMC’s 125-property portfolio.

Other strengths included the festive experience as well as providing shoppers the convenience and gratification of having the product immediately, according to North Plainfield-based commercial real estate services firm.

In commenting on the responses, Harding said retailers “know the holiday season is a vital time to get creative and step up their marketing investment in order to win business.”

As a result, 37.5% said they are leveraging new methods to enhance their customers’ holiday shopping experiences, such as new in-store customer services or loyalty programs, according to the survey. Additionally, nearly 30% have committed more resources to holiday marketing and about one-quarter are incorporating new marketing tools for the season.

At New Jersey’s second largest mall, Westfield Garden State Plaza in Paramus, Senior General Manager Wesley Rebisz told NJBIZ, “Shoppers still want to see, touch and smell, and based on the traffic patterns we have been seeing, we’re optimistic about potential purchases for ‘Holiday 2023.’ To that end, in addition to our annual Big Santa lighting and traditional photos with Santa, debuting this year is ‘Mrs. Claus’ Kitchen,’ a one-of-a-kind, memory-making, immersive holiday experience featuring a life-size gingerbread house offering timed experiences for families to visit Mrs. Claus.”

“These experiences are the catalyst for purchase, not necessarily mutually exclusive. Plus, with more opportunities that deliver the gift of time, including a host of new dining options at the mall and extended operating hours, we anticipate a robust holiday season with a variety of ways to unplug and reconnect with friends and family,” he went on to say.

At American Dream, the Meadowlands megamall has once again transformed itself into “Holiday Dreamland” for the season. Along with enjoying sales, festive décor and giveaways of prizes like shopping sprees, televisions, jewelry and gift cards, mall-goers can take photos with Santa Claus, grab holiday brunch, head to the Elf Workshop at Nickelodeon Universe for ornament decorating and crafting, or catch a train ride with Geoffrey the Giraffe at Toys R Us.

“Everything we do at American Dream is about providing our guests with memorable experiences and the very best in retail, dining and attractions,” said Bryan Gaus, the mall’s senior vice president and general manager. “Where else can you go down a water slide, ride a roller coaster, ski down a hill, shop at trending retail locations and then have a great meal at Carpaccio, Jarana or Marcus Live!?”

“Our retail experience is unique, consisting of flagship stores and boutiques throughout the property and an immersive luxury experience in The Avenue. We’ve added 30 new shops and restaurants since last holiday season and are excited to have even more on the way,” Gaus added.

Making spirits bright

Similar to the state’s two biggest shopping malls, the New Jersey retail sector is mostly in good spirits this season, with two-thirds of respondents to LMC’s poll saying they anticipate a positive performance. However, less than 20% of that group expect sales to be notably higher than last year — a finding that mirrors recent surveys conducted by Deloitte, the National Retail Federation and the International Council of Shopping Centers.

“The industry saw record seasonal growth in 2020 and 2021, followed by impressive performance again in 2022. All indicators point to another positive holiday period this year. That said, the crosscurrents of inflation and other economic concerns have retailers poised for comparatively modest sales increases,” Harding said.

He also believes shoppers will be “making fewer, yet more productive trips to the store this holiday season.”

“Cost-conscious consumers are doing their research and comparing pricing before they make purchases, a trend likely fueled by inflation. They are also prioritizing convenience. Thanks to technology and the omnichannel retail experience, they can easily go online to browse and find the places with the best deals and in-stock merchandise,” Harding explained. “For many shoppers, BOPUS [buy online, pick up in store] is an attractive way to take some of the guesswork out of unpredictable holiday shipping times. And when they go to pick up their online purchases, they may do some additional shopping while in the store.

“It’s important to recognize that less traffic does not necessarily translate into lower overall sales. Our survey asked participants about how their year-to-date sales and traffic stack up to what they expected at the beginning of 2023. While 70.2% say their sales volume has met or exceeded expectations, only 61.1% say their traffic has met or exceeded expectations,” he continued.

In ranking various drivers likely to affect sales, LMC survey participants said the economy/consumer confidence significantly outweighed factors such as shifting consumer expectations/shopping patterns and e-commerce growth.

This year’s poll provides further evidence of the ongoing shift of consumers shopping earlier for their holiday gift-giving purchases, with 30% of respondents anticipating their peak sales to occur prior to Black Friday weekend — a record high for the 12-year-old survey.

The Thanksgiving/Black Friday weekend tied with early December, with a combined 38% expecting their peak sales to occur in one of these timeframes, according to LMC.

Expectations of peak sales in mid-December and the weekend before Christmas tapered off considerably, as only a combined 19% forecast peak sales — the lowest percentages in survey history for both periods.

Respondents also expect a spike in December; just over 13% expect their peak seasonal sales between the day after Christmas and New Year’s, which, Harding said, likely reflects the anticipated draw of clearance sales and specials.

“While perhaps not surprising, the most interesting takeaway this year for our team is how pronounced the shift to early shopping has become. For more than a decade now, we have been asking our store managers when they expect their seasonal sales to peak. In 2023, 67.5% of our survey participants anticipate peak holiday sales by early December. For context, in 2013 the same metric was just 53.9%; by 2018 it had grown to 61.3%,” Harding said.

A slow go

Pointing to a combination of still-high inflation, elevated interest rates and the return of student loan repayments, the National Retail Federation projects U.S. holiday sales will rise at the slowest pace in five years.

The leading industry retail group predicts spending in November and December will grow 3%-4% over last year to between $957.3 billion and $966.6 billion. While that will be an overall record, spending is expected to grow more slowly than 2022 (5.4%), 2021 (12.7%) and 2022 (9.1%).

Before the pandemic – and the trillions of dollars of stimulus that led to unprecedented rates of retail spending – gains were more in line with this year’s growth, increasing 3.8% in 2019, 1.7% in 2018 and 5% in 2017.

NRF Chief Economist Jack Kleinhenz explained, “We expect spending to continue through the end of the year on a range of items and experiences, but at a slower pace. Solid job and wage growth will be contributing factors this holiday season, and consumers will be looking for deals and discounts to stretch their dollars.”

Despite cooling inflation, Americans are expecting higher prices for gifts and food, prompting them to make changes to their budgets, according to Deloitte’s holiday retail survey. Those adjustments include buying fewer gifts (eight in 2023 versus nine in 2022) and spending more on gift cards ($300 this year compared with $217 last year).

As retailers continue to roll out deals earlier and earlier, 79% are starting shopping for the holidays sooner than they typically do, the survey said. In fact, 1 in 4 shoppers began in August. Additionally, 66% plan to pounce on upcoming promotional events, like Black Friday and Cyber Monday, up from 49% a year ago, Deloitte reported.

Cherry Hill-based TD Bank’s annual Merry Money survey found that 70% of shoppers plan on making a budget before they deck the halls this season, but that nearly all (96%) expect to overspend on gifts.

Before they begin making their list, shoppers are trimming unnecessary spending, with 66% saying they are cutting back in other areas in anticipation of the holiday season.

Shoppers are also digging for deals, TD said. Eighty percent indicated they are actively seeking out price reductions or special offers, while 75% plan to do most holiday shopping around annual sales or events, like Black Friday (51%), Amazon Prime Day (33%) and Cyber Monday (30%).

Overall, budget-conscious shoppers are becoming slightly more optimistic about the economy, with 68% of respondents citing concerns around inflation’s impact on their holiday shopping needs, down from 75% in 2022, TD also found.